geothermal tax credit extension

For the year 2023 the incentive will be lowered to 22 for systems that are installed so act quickly to. For this reason you should consider helping this pass through.

Do Geothermal Heat Pumps Raise Your Electric Bill Dandelion Energy

4520 the American Jobs Creation Act of 2004 just approved by a Congressional Conference Committee.

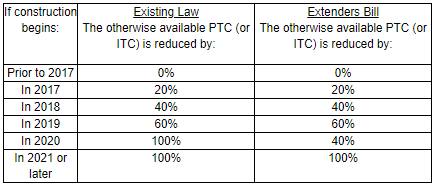

. Extension for commercial and residential geothermal heat pump GHP tax credits. In addition a two-year extension of the PTC for marine and hydrokinetic renewable energy systems will keep that tax credit in effect through 2013. Closed loop water-to-air heat pumps must have an EER energy efficiency ratio of 171 or greater and a coefficient of performance COP or 36 or more.

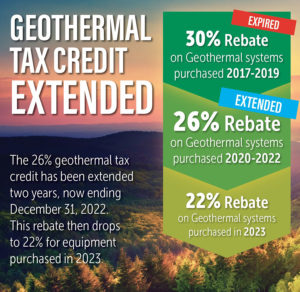

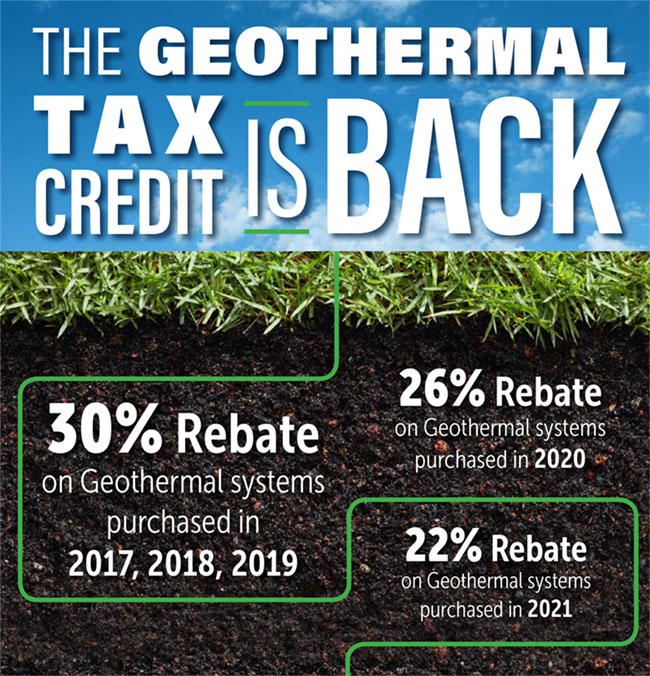

Residential credits are 26 through 2022 then decrease to 22. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings. The credit then steps down to 22 in 2023 and expires January 1 2024.

Geothermal Tax Credit Extended March 31 2021 The federal tax credit for geothermal installations was extended for two more years at the end of 2020. The Energy Efficiency Property Tax Credit residential credit for GHPs is extended for two years at its current level of 26 of total installation cost. In 2023 the credit steps down to 22 and then expires on Jan.

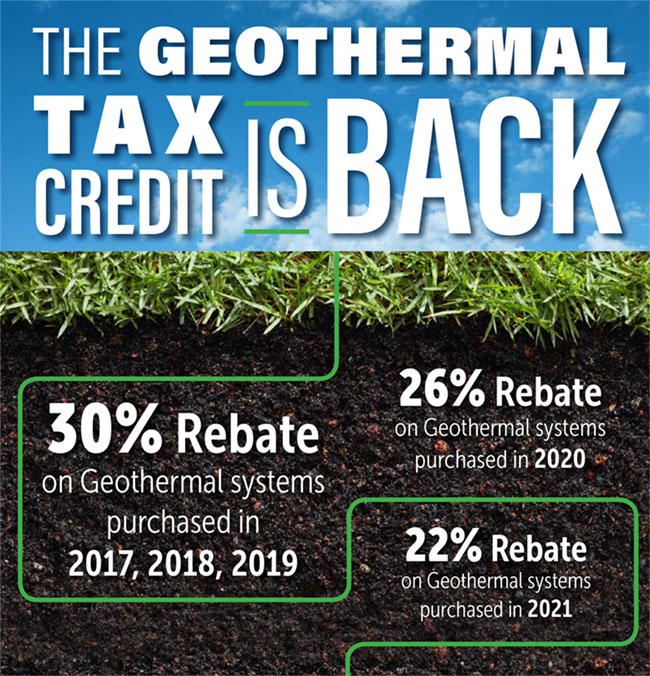

Start And Finish In Just A Few Minutes. The federal geothermal tax credit was reinstated in 2018 after expiring in 2016 this time including commercial geothermal heat pumps as eligible energy systems. As of December 2020 the tax credit was extended to the end of 2023 making now the perfect time to begin construction on arguably the most efficient heating and cooling systems on the market.

For Municipal utility energy programs visit Muni-Helps. As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US. You can claim the credit for the year the repair or replacement work is completed.

House of Representatives Ways and Means Committee to recommend extending federal tax credits for residential and commercial geothermal heat pump GHP installations beyond their Dec. In order to qualify your unit must meet certain minimum criteria. 31 2016 expiration date through.

In 2023 and expire January 1 2024. Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies. Mass Save is the Commonwealths nation leading energy efficiency program provider.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Production Tax Credit PTC -- a critical factor in stimulating the growth of the US wind industry -- is very likely to be expanded to include geothermal energy as part of the JOBS tax package HR. Get Your Max Refund Today.

Geothermal Tax Credit Extended. New geothermal heat pumps and combined heat and power projects will qualify for a 10 investment tax credit if construction starts by the end of 2023. In 2019 the tax credit was renewed at 30 of the total system cost which dropped to 26 in 2020.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is. Participating municipal utilities listed here or contact utility directly.

Congress authorized a 30 investment tax credit to be claimed on new power plants of up to 50 megawatts in size that generate electricity using waste heat from buildings and other equipment. Heating and cooling lighting. Below are a list of included services for home owners of single family homes and up to 4 units in a multi-family property.

The new legislation lengthens the deadline for the credits for GHP installations. Ultimately the tax credit was reinstated in early February 2018. It will save you money upgrading your geothermal system or upgrading to geothermal.

From 2017 to January of 2018 there was an ongoing fight to extended this tax credit. In July a bill was introduced to the. Geothermal equipment that uses the stored solar energy from the ground for heating and.

Complete Edit or Print Tax Forms Instantly. Fast And Easy Tax Filing With TurboTax. Access IRS Tax Forms.

The extension keeps the wind energy PTC in effect through 2012 while keeping the PTC alive for municipal solid waste qualified hydropower and biomass and geothermal energy facilities through 2013. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. The federal tax credit for geothermal installations was extended for two more years at the end of 2020.

Commercial credits will remain at 10 through 2023. Residential Energy-Efficient Property Credit. Federal tax credits cover up to 30 of the cost of installing a geothermal heat pump on your property.

When calculating the credit subtract any interest subsidies you received from Massachusetts. Federal Tax Credit The recently signed Federal Budget and Stimulus bill includes an extension of the Federal geothermal heat pump GHP tax credits through 2023. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water.

In 2023 the credit steps down. As lawmakers hotly debate budget cuts and tax reform in Washington DC the Geothermal Exchange Organization GEO has formally asked the US. Property is usually considered to be placed in service when installation is complete and equipment is ready for use.

Federal Tax Credit The recently signed Federal Budget and Stimulus bill includes an extension of the Federal geothermal heat pump GHP tax credits through 2023. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009. This number will carry through until the end of 2022 and drops to 22 in 2023.

This would mean a 30 tax credit through 2024 a 26 tax credit in 2025 and a 22 tax credit in 2026. The extension keeps the tax credit at 26 for residential geothermal for 2021 and 2022. From now through December 31 2022 a federal tax credit for residential ground source heat pump installations has been extended.

The Energy Efficiency Property Tax Credit residential credit for GHPs is extended for two years at its current level of 26 of total installation cost. To qualify for the credit. The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits.

In July a bill was introduced to the House and Senate to push for a five-year extension of the 30 tax credit for Geothermal systems. The total amount of the credit cannot exceed 6000. The new legislation lengthens the deadline for the credits for GHP installations.

This Tax credit was available through the end of 2016. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. The credit is 40 40 of the costs not to exceed 15000.

Solar And Wind Tax Credits Extended Again Tax Equity Times

Recent Legislative Proposals Could Drastically Change Us Energy Taxation Mayer Brown Tax Equity Times Jdsupra

Geothermal Tax Credit Reinstated Corken Steel Products

Geothermal Tax Credit Extended Illinois Country Living Magazine

Congress Unveils Energy Tax Extenders Lexology

Filing For Residential Energy Tax Credits What You Need To Know

Stabilizing At The New Normal For Renewable Newbuild Ihs Markit

Understanding The Geothermal Tax Credit Extension

Geothermal Investment Tax Credit Extended Through 2023

Solar And Wind Tax Credits Extended Again Tax Equity Times

Geothermal Investment Tax Credit Extended Through 2023

Geothermal Tax Credits Incentives

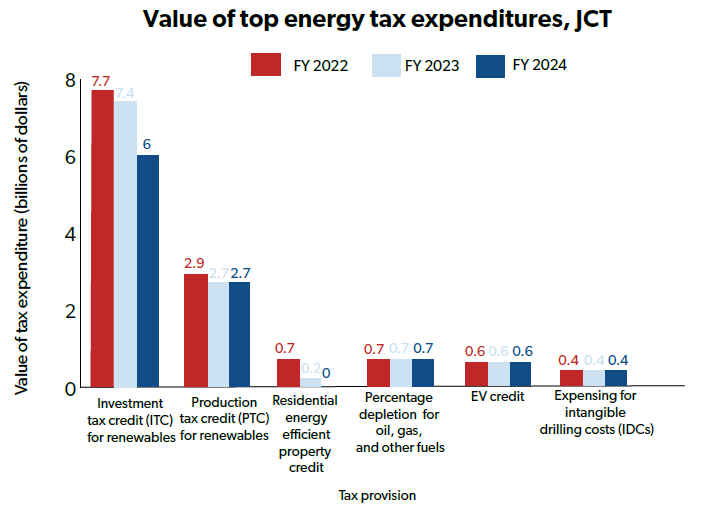

What S The Deal With Energy Taxes Publications National Taxpayers Union

Geothermal Solaire Home Comfort

Geothermal Tax Credit Extended Illinois Country Living Magazine

Geothermal Tax Credit Reinstated Corken Steel Products

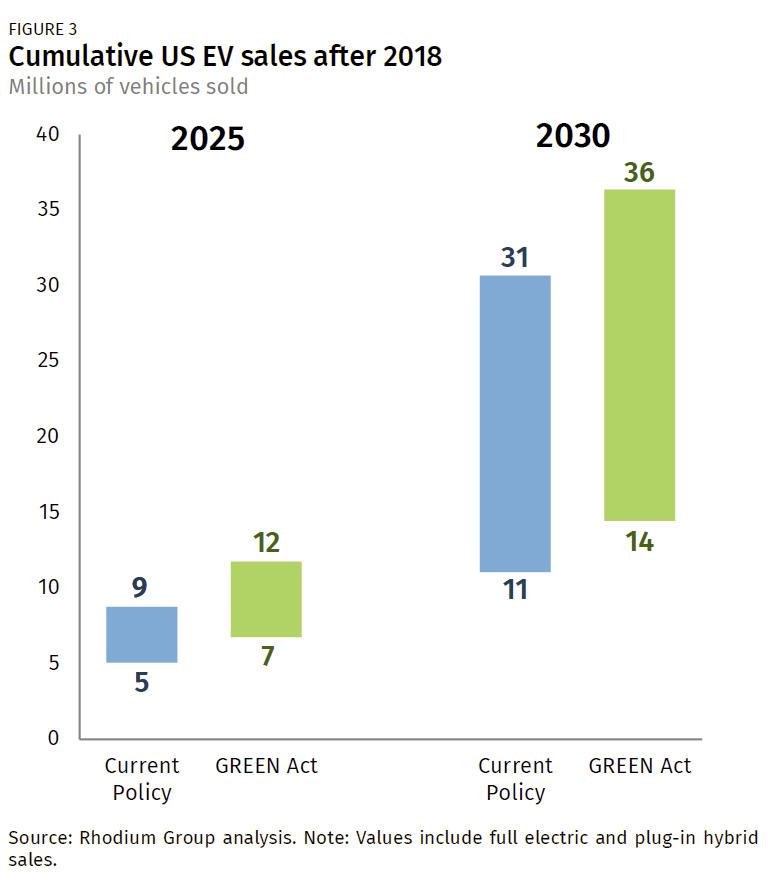

An Assessment Of The Green Act Implications For Emissions And Clean Energy Deployment Rhodium Group